How Personal Loans copyright can Save You Time, Stress, and Money.

How Personal Loans copyright can Save You Time, Stress, and Money.

Blog Article

Facts About Personal Loans copyright Uncovered

Table of ContentsPersonal Loans copyright Can Be Fun For AnyoneGetting My Personal Loans copyright To WorkSome Known Questions About Personal Loans copyright.Personal Loans copyright Fundamentals ExplainedPersonal Loans copyright Fundamentals Explained

Let's dive into what a personal financing really is (and what it's not), the factors people use them, and exactly how you can cover those insane emergency costs without handling the problem of financial debt. An individual funding is a round figure of cash you can borrow for. well, almost anything.That doesn't consist of obtaining $1,000 from your Uncle John to help you spend for Xmas offers or letting your flatmate spot you for a pair months' rent. You should not do either of those things (for a variety of reasons), yet that's technically not a personal car loan. Individual loans are made via an actual monetary institutionlike a financial institution, lending institution or on the internet lending institution.

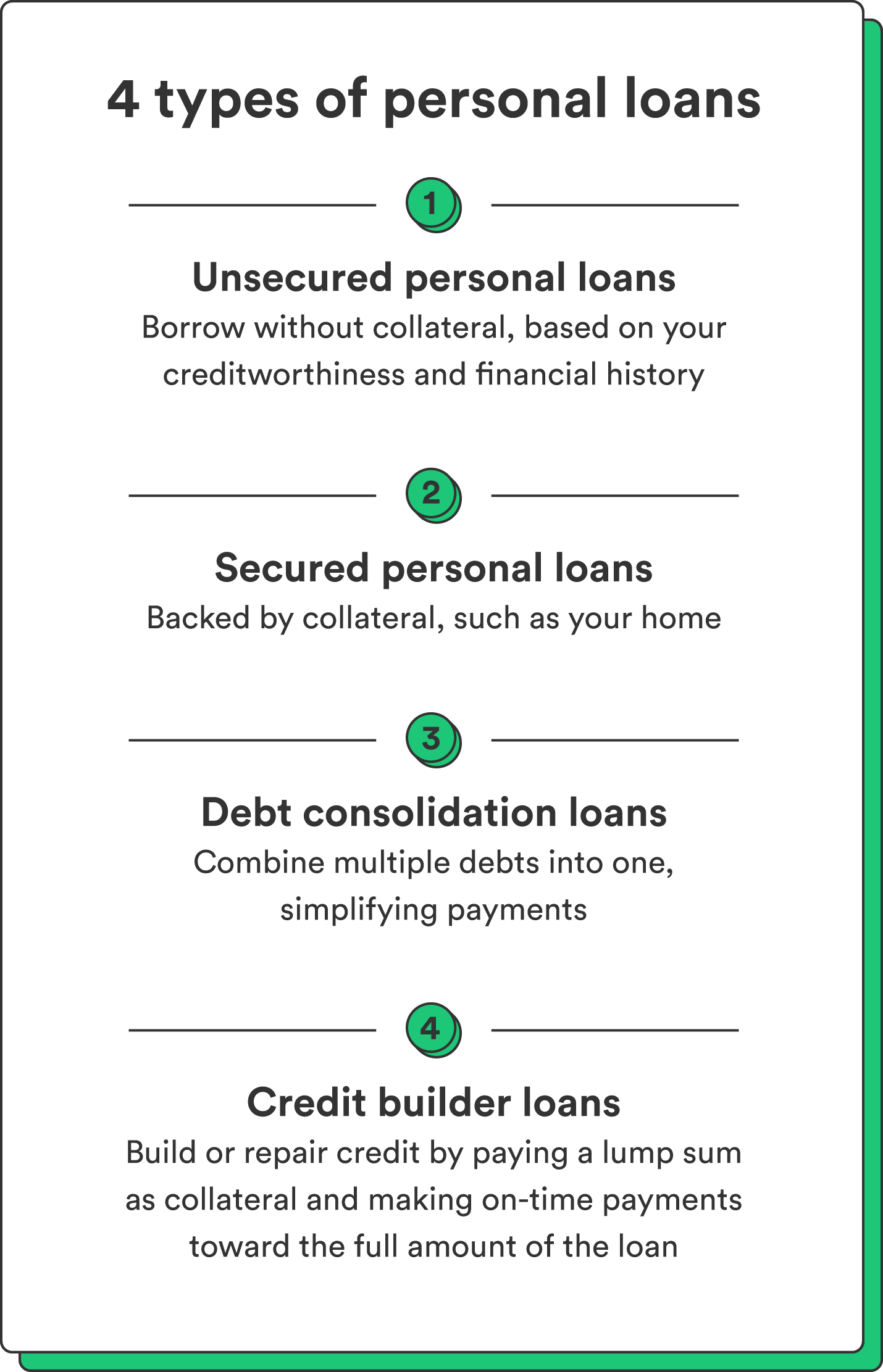

Allow's take a look at each so you can know precisely just how they workand why you don't require one. Ever before. A lot of individual loans are unsecured, which implies there's no security (something to back the car loan, like an auto or home). Unsafe financings typically have higher rates of interest and require a much better credit history due to the fact that there's no physical item the loan provider can eliminate if you do not pay up.

What Does Personal Loans copyright Do?

Surprised? That's alright. No matter how good your credit rating is, you'll still need to pay interest on most personal lendings. There's constantly a cost to spend for obtaining money. Protected individual car loans, on the various other hand, have some kind of collateral to "protect" the loan, like a boat, fashion jewelry or RVjust among others.

You might additionally obtain a protected individual finance utilizing your car as security. But that's a harmful action! You don't want your primary setting of transport to and from job obtaining repo'ed since you're still spending for in 2014's cooking area remodel. Depend on us, there's absolutely nothing safe and secure about safe finances.

Simply due to the fact that the payments are predictable, it doesn't indicate this is an excellent bargain. Personal Loans copyright. Like we claimed in the past, you're basically assured to pay rate of interest on a personal financing. Simply do the math: You'll wind up paying way more in the lengthy run by getting a funding than if you 'd simply paid with cash money

Little Known Facts About Personal Loans copyright.

And you're the fish holding on a line. An installment funding is an individual lending you pay back in dealt with installments gradually (normally as soon as a month) till it's paid in full - Personal Loans copyright. And do not miss this: You have to repay the original car loan amount prior to you can borrow anything else

Don't be mistaken: This isn't the same as a debt card. With personal lines of credit history, you're paying rate of interest on the loaneven if you pay on time.

This one obtains us riled up. Because these businesses prey on people who can not pay their expenses. Technically, these are short-term lendings that give you your paycheck in development.

The Single Strategy To Use For Personal Loans copyright

Why? Because things obtain real untidy real quick when you miss out on a settlement. Those creditors will certainly follow your wonderful grandmother that guaranteed the finance for you. Oh, and you ought to never ever guarantee a car loan for any person else either! Not only can you obtain stuck with a finance that was never indicated to be yours to begin with, however it'll wreck the relationship before you can say "compensate." Depend on us, you do not desire to be on either side of this sticky official website circumstance.

All you're truly doing is utilizing new financial debt to pay off old financial debt (and extending your financing term). Companies know that toowhich is exactly why so numerous of them offer you consolidation loans.

And it starts with not borrowing anymore cash. ever. This is an excellent general rule for any monetary purchase. Whether you're considering obtaining an individual loan to cover that kitchen remodel or your overwhelming debt card bills. do not. Obtaining debt to pay for points isn't the way to go.

See This Report on Personal Loans copyright

The most effective thing you can do for your economic future is leave that buy-now-pay-later frame of mind and state no to those investing impulses. And if you're considering an individual car loan to cover an emergency, we obtain it. However obtaining cash to spend for an emergency only escalates the anxiety and difficulty of the circumstance.

Report this page